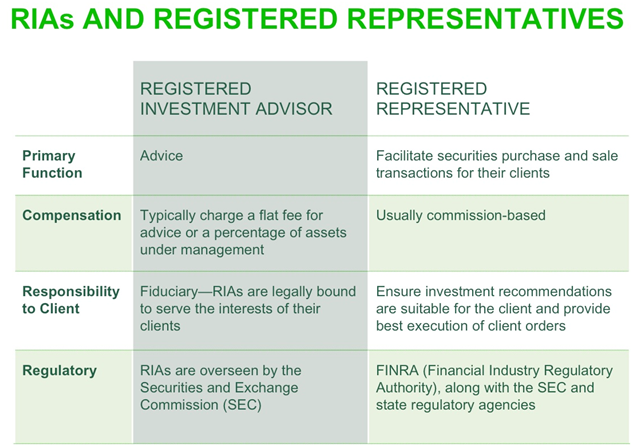

Even those who rescue themselves need occasional help from a professional, and there are two basic models for the investment industry. The lines between these two models are often blurred by advertising, so we would like to draw a clear distinction between them for our readers. The two models are a broker and a Registered Investment Advisor, and the key differences lie in how each is compensated and the standard to which each is held.

Brokers are typically compensated by commission per transaction. They are paid a percentage up front for selling a stock, bond, mutual fund, CD or annuity. Of these, the largest commissions are often generated from the sale of annuities and illiquid limited partnerships that can pay as much as a 10% of your investment. Of course, the broker hopes that the investment performs well so there will be an opportunity to sell more products, but in any event, the broker is paid up front. The standard a broker must meet is called “suitability,” meaning any security sold must be suitable for the client to own, based on his or her goals and means. After that standard has been met, brokers are not required to disclose their compensation and they act in their employer’s best interest.

A Registered Investment Advisor is typically compensated based on a percentage of assets under management: a structure that makes the number of transactions generated by the advisor irrelevant to the advisor’s compensation. If the advisor’s fee is 1% annually, for example, it would take the advisor several years to earn what a broker generally makes on one upfront commission from the sale of a security like a limited partnership or an annuity. An advisor is also held to a “fiduciary standard,” meaning advisors are legally bound to place the interests of the client above their own.

At Southern Capital, we chose the advisor role where we only receive compensation from client fees. We get nothing from product vendors, therefore avoiding potential conflicts of interest. We also must disclose ahead of time how much we will be compensated. Other professionals who serve in a fiduciary capacity include doctors, lawyers, CPAs and trust officers. One other important thing to remember is that the term “fee-based” is not the same as “fee only.” A fee-based advisor might receive both fees and commissions.